Lifelong Pension with Pak-Qatar only

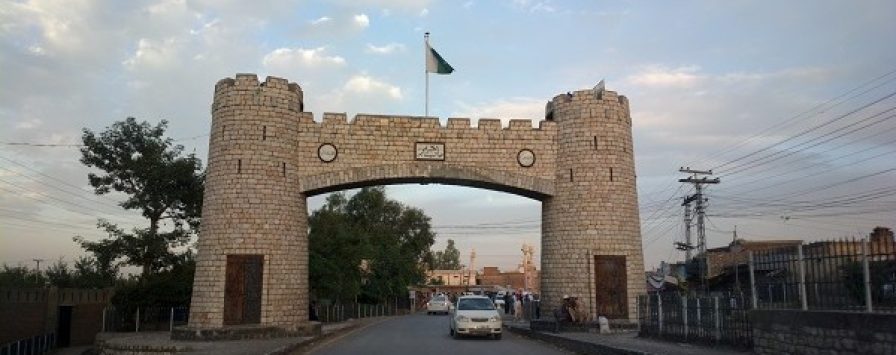

Pak-Qatar Family Takaful Limited; Pakistan’s first and leading Takaful operator, brings you a

secure, flexible, and Shariah-compliant pension solution under the Khyber Pakhtunkhwa (KP)

Government Employees Contributory Pension Scheme.

With our ethical investment approach and commitment to long-term financial security, we

empower you to build a retirement plan based on Takaful values, transparency, and trust.

Unlock financial security and peace of mind through a host of benefits

Investment Solution

through our Mobile App

PKR 500,000 up to PKR 7 Million

Minimum Coverage

PKR 500,000 or 1 time the employee’s

account balance (whichever is higher)

Maximum Coverage

Up to

PKR 7 million

Found a Shariah compliant financial solution that aligns with your needs?

Then share your details below and our experts will help you make the right choice!

All investments in Mutual Funds and Pension Funds are subject to market risks. Past performance is not necessarily indicative of future results. Please read the offering document to understand the investment policies, risks and tax implication involved.

As per section 63 of the income tax ordinance 2001, an eligible person contributing in Approved Pension Fund can avail tax credit up to 20% of the (eligible) person’s taxable income for the relevant tax year. This information is for general purpose only. In view of individual nature of tax consequences each investor is advised to consult with his/her tax advisor with respect to specific task consequences of investing in the fund.